A recent discussion on Proformative.com centered on Non-Exempt employees and Overtime.

A recent discussion on Proformative.com centered on Non-Exempt employees and Overtime.

This area of Labor Law is extremely confusing; best clarified by both an expert HR Consultant and Labor Attorney; but I will give you a broad-stroke definition.

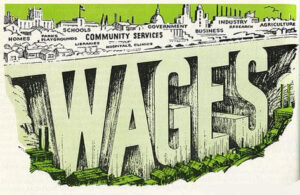

Nonexempt employees are entitled to overtime pay. Exempt employees are not. Most employees covered by the Fair Labor Standards Act (FLSA) are nonexempt. Some are not.

Simple isn’t it.

According to the Act there are several tests. They revolve around duties, salary and whether or not you are a computer professional (a whole additional sub-section). This might be a good place to start to understand the complexity of exemption: https://www.dol.gov/whd/overtime_pay.htm

But lets go back a step and assume the first statement is true, that MOST employees are covered by the FLSA, and they are entitled to overtime. How do you, as an employer, know if you are paying your employees properly (so you don’t get a claim filed against you for non-payment)?

One participant on the Proformative forum stated that with proper policies and procedures, the employer can mitigate OT, and hence outlaw certain behaviors which they deem inappropriate and not working for the employer.

In theory, that is a great idea. No working from home. No coming in early. No staying late, all without prior authorization from a supervisor. But there is a fly in that ointment, and its called unjust enrichment.

The DOL (as well a contract law) considers unjust enrichment The retention of a benefit conferred by another, that is not intended as a gift and is not legally justifiable, without offering compensation, in circumstances where compensation is reasonably expected. – http://www.law.cornell.edu/wex/unjust_enrichment

Thereby, is an employee comes into work early, even if the rules say no, does work, they are entitled to OT should the total number of hours work exceed statutory limits.

One might even say that answering e-mail or phone calls might be considered working and as such, OT may be accrued to non-exempt employees.

What can you do?

There is only one, sure-fire method to stop abuses of the OT laws; lock your employees out of the workplace when they are not to be working. If all work done by employees are done in your establishment, and they don’t have access, you have no issue.

The other method, which may mitigate future behaviors, after you’ve paid OT for prior transgressions are administrative in nature. You can demote or deny promotion, dock pay or furlough the employee, or ultimately fire the employee for breaking company policy, but just to be clear, AFTER you’ve paid OT to that employee.

Final Analysis

In the end, you as an employer must protect the company. I strongly suggest again hiring an expert HR consultant and an experienced Labor Attorney! Discuss your specifics with these people and create a workable plan.