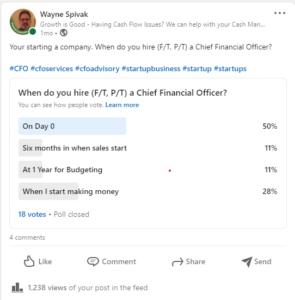

A recent poll on LinkedIn posted by SBA * Consulting asked this very question. We even widened the question by including both full-time and part-time (fractional) CFOs.

A respectable 1,238 people looked at the poll with a 1.45% response rate (18 votes). While not a very scientific poll, it still says something about the mindset of businesspeople.

A full fifty percent of respondents believe that a CFO is crucial to the success. They want a CFO onboard as of day zero. Twenty-two percent feel a CFO is needed within the first year. And lastly 28% feel a CFO is an expense not wanted till the company starts making money.

Misconceptions of what is and isn’t a CFO

If I were to accept that this poll was scientifically accurate, 50% of businesspeople understand the role and value the input in helping a business succeed. Clearly one-half have a different viewpoint, with a little more than half of that group who just don’t get it. The 28% who would hire the CFO after making some money.

Oxford Languages defines a CFO (Chie Financial Officer) as

“noun

a chief financial officer, a senior executive with responsibility for the financial affairs of a corporation or other institution.”

NetSuite defines the CFO as:

“What Is a Chief Financial Officer (CFO)?

A chief financial officer (CFO) is the highest-ranking financial professional in an organization and is responsible for the fiscal health of the business. The CFO’s responsibilities include, but aren’t limited to, building a top-notch finance and accounting team, ensuring revenues and expenses stay in balance, overseeing FP&A (financial planning & analysis) functions, making recommendations on mergers and acquisitions, obtaining funding, working with department heads to analyze financial data and craft budgets, attesting to the accuracy of reports and consulting with boards of directors and the CEO on strategy.

CFOs may also help set technology direction, especially fintech, and make recommendations on everything from supply chain to marketing based on their fiscal insights and industry knowledge.

The most-valued CFOs are visionaries — they have an eye toward the future, work closely with top leadership and aren’t shy about recommending strategic moves.”

Rami Ali – Chief Financial Officer (CFO) Defined: Role, Responsibilities and Skills

Another definition, this time from the CFI:

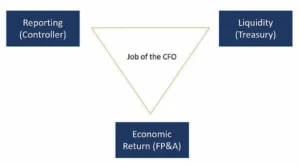

The Corporate Finance Institute has a nice article, and this graphic (on the left) covers the meat of their definition. In addition, they state:

The Corporate Finance Institute has a nice article, and this graphic (on the left) covers the meat of their definition. In addition, they state:

“What Else Does a CFO Do?

Surely the above is not all a CFO does. Well, the above is actually quite a lot for a CFO to do, but there are other duties that include leadership, communication with the board, negotiating with suppliers and vendors, and supporting the company’s mission, vision, values, and culture.

Other groups that might report to the CFO include supply chain, procurement, information technology (IT), and almost any other department, depending on the organization and the skill set of the CFO.”

If one were to sum up the role of the CFO, it’s at a minimum a combination of accounting, finance, M&A, IT, Supply Chain, Marketing, Legal and other elements. One element not clearly delineated above is business acumen.

That’s a lot of knowledge that a CFO needs to be familiar with. They don’t need to be an expert, there are plenty of Subject Matter Experts within and without the company that can provide their specific knowledge. But it is the amalgamation of the CFO’s knowledge base that makes the CFO so valuable an asset to the company.

So, when do you hire your first CFO?

From the above information, every business needs a CFO from the start. That person can be fractional and even once a month. But as you start to build out your business, create your processes, hire your staff, you’ll want the expert advice that a Chief Financial Officer can provide your business.

Don’t be penny wise and dollar foolish.