If you look at the adverts for CFO jobs on LinkedIn and elsewhere, you’ll find many of the job descriptions are similar. The overwhelming majority talk about accounting, accounting skills and being a CPA (usually from a big firm).

We wondered if this was true, so we went to the proverbial source; where else, but on LinkedIn.

The Question:

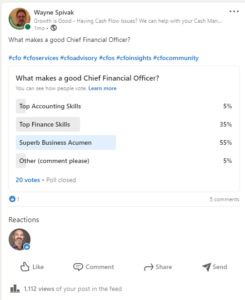

We asked the following question, in a poll last month on LinkedIn. “What makes a good Chief Financial Officer?”

The twenty respondents (out of 1,115 views, so definitely not a scientific survey) came from an interesting cross section of professions. CEO, CFO, COO, Controller, Accountant, M&A specialist, Finance, Educator, HR. Recruiter, Sales, Lawyer, and a medical professional.

The twenty respondents (out of 1,115 views, so definitely not a scientific survey) came from an interesting cross section of professions. CEO, CFO, COO, Controller, Accountant, M&A specialist, Finance, Educator, HR. Recruiter, Sales, Lawyer, and a medical professional.

The Results

Interestingly, the preponderance of votes suggested the most important skill is Business Acumen (55% of votes), followed by Top Finance Skills (35%). Top Accounting Skills and Other skill sets each got 5% of the votes.

Interesting results, with the exact percentages of reality.

The Takeaway:

You should not hire a CFO solely because they are a CPA, or they worked at a large public CPA firm. Accounting is not the primary focus of the CFO role, which belongs to the Controller. Obviously, mileage will vary depending on the size of the company and the CFOs shop.

Finance

“Corporate finance deals with the capital structure of a corporation, including its funding and the actions that management takes to increase the value of the company. Corporate finance also includes the tools and analysis utilized to prioritize and distribute financial resources.

The ultimate purpose of corporate finance is to maximize the value of a business through planning and implementation of resources, while balancing risk and profitability.” “What is Corporate Finance? ” By the Corporate Finance Institute

While the CFO needs a background in Finance, much of the number crunching can be spread-out in your financial planning and analysis (FP&A) staff. Depending again on company size, the complexity of FP&A may not require dedicated staff.

Business Acumen and the CFO

Your hiring criteria should center around Business Acumen. What experiences in industry (both the readers and others) have the Chief Financial Officer candidate had during their career? Were the circumstances unique? What did they build, defend, transform?

The more experience in different sectors and industry the better, since they have garnered large swaths of different “what ifs”. Each different company, industry, and sector will add to their cumulative Business Acumen.

Lastly, whatever accounting or finance skillsets that may be missing, can be filled by Subject Matter Expert’s. That is part of the reason why you have a General Counsel and a Public Accounting firm, as well as other specialized consultants.

A recent article in the Wall Street Journal characterizes the confusion of CFO’s. “CFOs Find It Harder to Land Board Seats as Companies Seek Change” states “That is spurring companies to fill their boardrooms with a wider range of experiences and skills, making it difficult for some chief financial officers to find a seat at the table with financial expertise alone.” I think CFO’s need to up not so much their game, but their perception!

You can’t gain deep Business Acumen without a broad business background.

Next time your firm needs either the first CFO or a new CFO, remember business acumen is the key component!