Released: April 3rd, 2017

Released: April 3rd, 2017

Press Release

Friends and colleagues,

For the last year, I have been a partner at Hardesty LLC. It has been a rewarding experience both personally and professionally. However, it was time to move on.

As of April 1st , I resigned as a partner and will be devoting my skills and energy to my current clients, potential clients and my businesses.

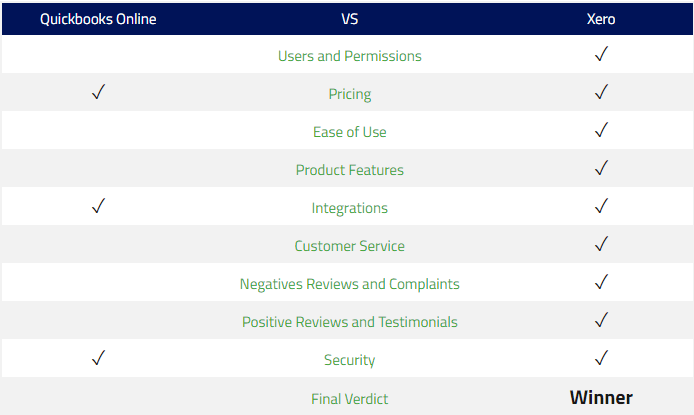

SBA * Consulting (www.SBAConsulting.com) has a new website and we have brought in Oswaldo Salazar, EA (Oswaldo.Salazar@SBAConsulting.com) to focus on the small business segment. To this end, we have focused more resources on our Xero accounting system practice. We will also be setting up a division to do virtual bookkeeping for those small and nascent companies.

We still are committed to the mid-market and providing CxO’s (albeit mostly CFO’s) to companies that need interim, part-time our outsourced experienced CFO’s. We also can assist in a large range of projects that require the same skill sets, but as a consultant to the CFO other C-Suite members.

Many of you know that I am a partner at Management Interactive LLC (MI) (www.managementinteractive.com) whose website is being created as you read this letter. As a symbiotic company, MI assists smaller companies with preparing for investors, going after capital investment and exits.

Part of this requires assistance with business planning, budgeting, and implementation of accounting systems and policies. Implementing these systems not only will help the business to grow, but pass muster on due diligence. I think you can see the crossover symbiotic nature of the relationship.

I look forward to connecting with you and appreciate any leads as we work worldwide and remotely.

Yours,

Wayne Spivak

Growth is Good

- We understand your problems.

- Are you ready for the solution?

- Our outsourced CxOs are prepared to help

WSpivak@SBAConsulting.com +1 (516) 221-3306

Since we’ve been in business we have received calls about helping companies obtain a SBA Small Business Loan. Our answer is always the same, go to a bank.

Since we’ve been in business we have received calls about helping companies obtain a SBA Small Business Loan. Our answer is always the same, go to a bank. The question now becomes how you protect your IP. First, you need to determine whether it will be worth something, to some investor down the road. The considerable dollars spent on trademark protection may worth every penny.

The question now becomes how you protect your IP. First, you need to determine whether it will be worth something, to some investor down the road. The considerable dollars spent on trademark protection may worth every penny. Released: April 3rd, 2017

Released: April 3rd, 2017

Obviously, in any case the business needs to be attractive. The value proposition needs to be solid. The staff skilled and energized. The technology current. The processes smooth allowing for peak production. A business plan that is sound as well as budgets and forecasts that make sense. Lastly, on this list, but certainly not in a business, the accounting needs to be on the mark.

Obviously, in any case the business needs to be attractive. The value proposition needs to be solid. The staff skilled and energized. The technology current. The processes smooth allowing for peak production. A business plan that is sound as well as budgets and forecasts that make sense. Lastly, on this list, but certainly not in a business, the accounting needs to be on the mark.