Definition of Fraud:

Definition of Fraud:

noun

* wrongful or criminal deception intended to result in financial or personal gain.

“he was convicted of fraud”

synonyms: fraudulence, cheating, swindling, embezzlement, deceit, deception, double-dealing, chicanery, sharp practice; More

* a person or thing intended to deceive others, typically by unjustifiably claiming or being credited with accomplishments or qualities.

“mediums exposed as tricksters and frauds”

synonyms: impostor, fake, sham, charlatan, quack, mountebank;

Fraud: it brings on many changes

It’s a reoccurring theme, just like in the lyrics of “Suicide is Painless” (the theme to M*A*S*H, only in the movie did you ever hear the lyrics). It sucks the life blood out of your business. And it can bring complete financial ruin. It is contagious. Slowing its spread can be difficult. Like the common cold it can’t be stopped.

Jeramy Kaiman VP Accounting Principals wrote a blog on detecting fraud “How to Detect Accounts Payable Fraud“. In it he describes three ways to uncover the chicanery.

- Consider the human element.

- Verify all vendors.

- Test transactions.

All valid steps. Some of the human elements Kaiman talks about are telltale signs that a person is open to corruption. Mr. Kaiman talks about living beyond one’s means, other traits are being disgruntled, showing antisocial and other behavioral issues at work. As I said, these signs show that a person is open, not that they are or will be corrupted. This leads to additional methodologies that diminish the ability to commit fraud.

How can you combat fraud?

What’s good for the goose is good for the gander.

Don’t let the managers flaunt their positions. Don’t have two sets of rules, one for them, the other for us. That just adds discontent, malice and destroys morale. Bad morale leads to disgruntled employees and an increase in fraud and a decrease in productivity.

Conspiracy theory. Have you ever played telephone as a kid. A bunch of kids sit in a line or large circle. Someone whispers a pre-written sentence to the first in line, and they share it with the person next to them. Upon the last person hearing the sentence, have that person tell the whole group. The original sentence is compared. Invariably it has no bearing on that written sentence. Now think conspiracy

One person, easy to keep a secret. Two people a little more difficult. Three more difficult and the difficulty gets harder as the circle is widened. Institute internal controls.

Make sure multiple people need to not only approve, but look at the transactions. Use technology and pre-existing rules and procedures in that technological system. Limit or eliminate exceptions to the rules.

If everthing is an exception; than the exception becomes the rule!

Have an outside party review your internal controls.

Like we said, you can’t eliminate fraud, but you can minimize and mitigate it.

Don’t be fooled

By the way, there is fraud in Accounts Payable, Accounts Receivable, Sales, Inventory, Purchase Orders. In fact there can be games played in every aspect of your business and the accounting system. When key people go on vacation (and you must insist that everyone take at least 5 consecutive days of vacation), look at their work and see if it is on the up and up. Not taking vacations or 5 consecutive days is also a telltale (besides being unhealthy).

Vishing Definition

Vishing Definition Definition of Fraud:

Definition of Fraud:

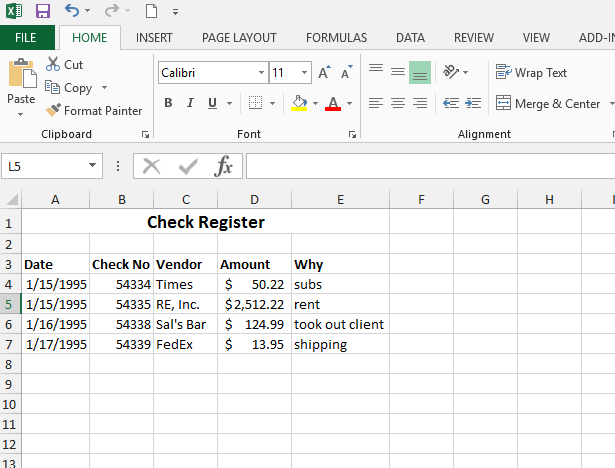

Too often the start-up company doesn’t see a need to implement accounting and

Too often the start-up company doesn’t see a need to implement accounting and  I cannot remember when a conversation has ever ensued that discussed revenue streams in this context. The differentiation of products and services to obtain

I cannot remember when a conversation has ever ensued that discussed revenue streams in this context. The differentiation of products and services to obtain