Bank Reconciliation

Too often the start-up company doesn’t see a need to implement accounting and accounting controls. They start their new company and run their business out of their checkbook. Their check register and bank statement become their accounting system. Not only that, they never do a bank reconciliation.

Too often the start-up company doesn’t see a need to implement accounting and accounting controls. They start their new company and run their business out of their checkbook. Their check register and bank statement become their accounting system. Not only that, they never do a bank reconciliation.

This mode of operation is fraught with issues that can ruin a good idea faster than that speeding bullet.

How often do you do your bank reconciliation on your personal account? Did you record all those checks? What about the zillion debit card transactions? How do you know someone didn’t slip an unauthorized check or charge into the mix?

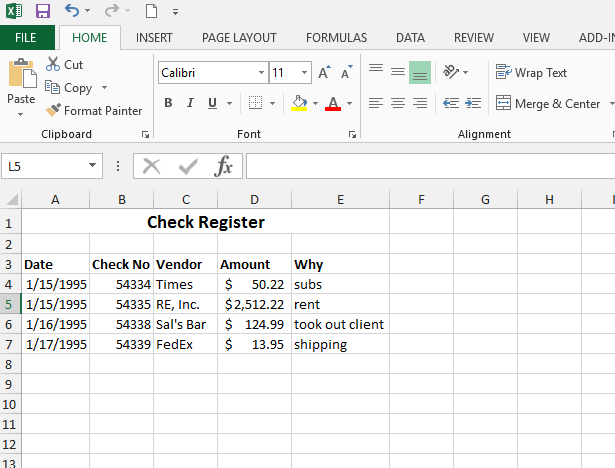

The picture to the right is a simplistic check register. Not much different than the register’s that come with your checkbook. So what’s wrong with this register? I see several issues. Most glaring is there are missing check numbers. What happened to check 54356 and 54357? Were they destroyed, are the saved for future use (and why) or did you forget to record them. If you did use them, how much were they for? Are you now in overdraft?

Or, did someone take the checks and commit a fraud?

Is your company checks and checkbook locked away?

Do you have a process for writing checks?

Accounting System Check Register

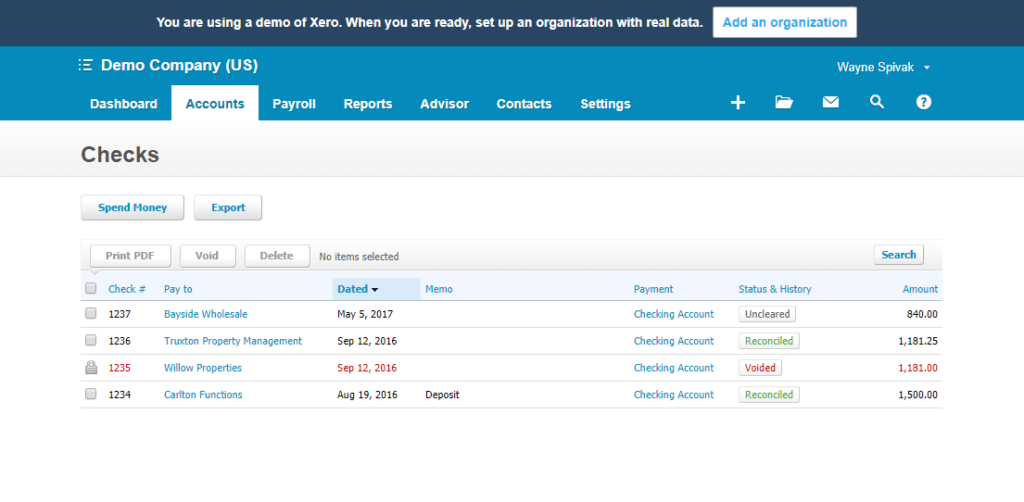

Here is an example of the check register from Xero. It isn’t that much different than many other accounting systems. Let’s examine the differences.

Check Register

The Xero register has all the same information as the manual/Excel register, but with several important differences

1 It has a Status & History column. You can see immediately if the check is outstanding (uncleared) or reconciled (cleared, paid by the bank). Voided checks are noted. Xero informs you if the voided check was done on a different date.

You have the ability to drill down and see the actual accounting behind the checks.

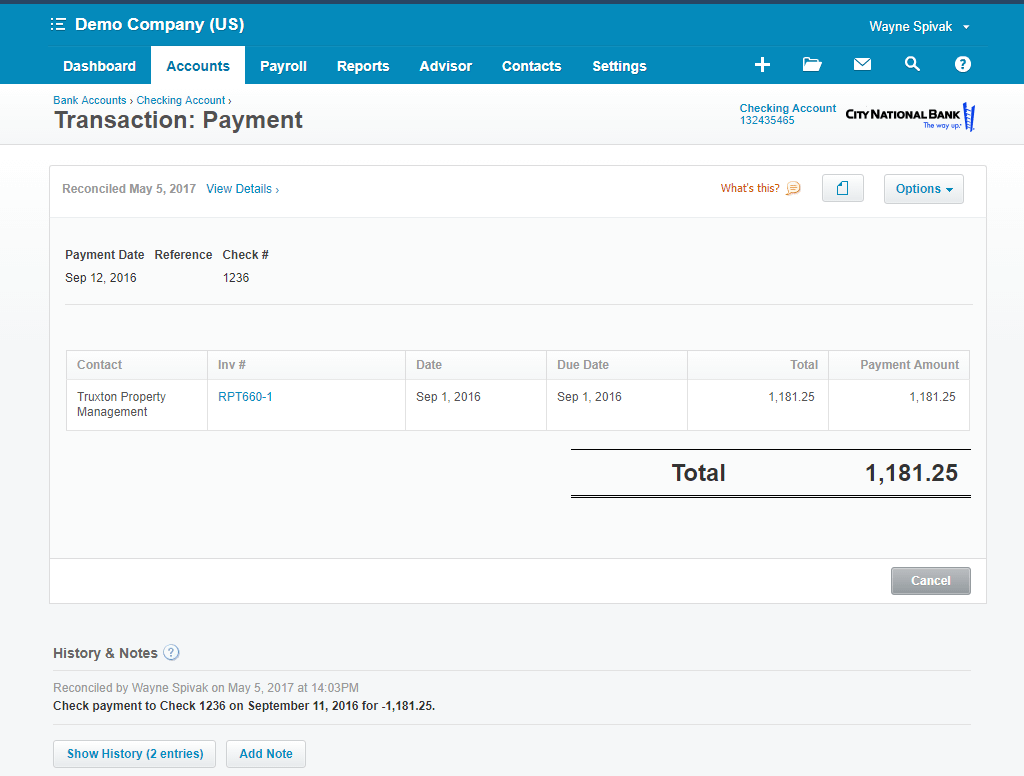

Transaction Payment

The payment transaction provides additional information including the Invoice number that was paid.

Notice the History & Notes. Every time this transaction was touched (changed), an audit trail is created.

Now you or the accountant can track what was done.

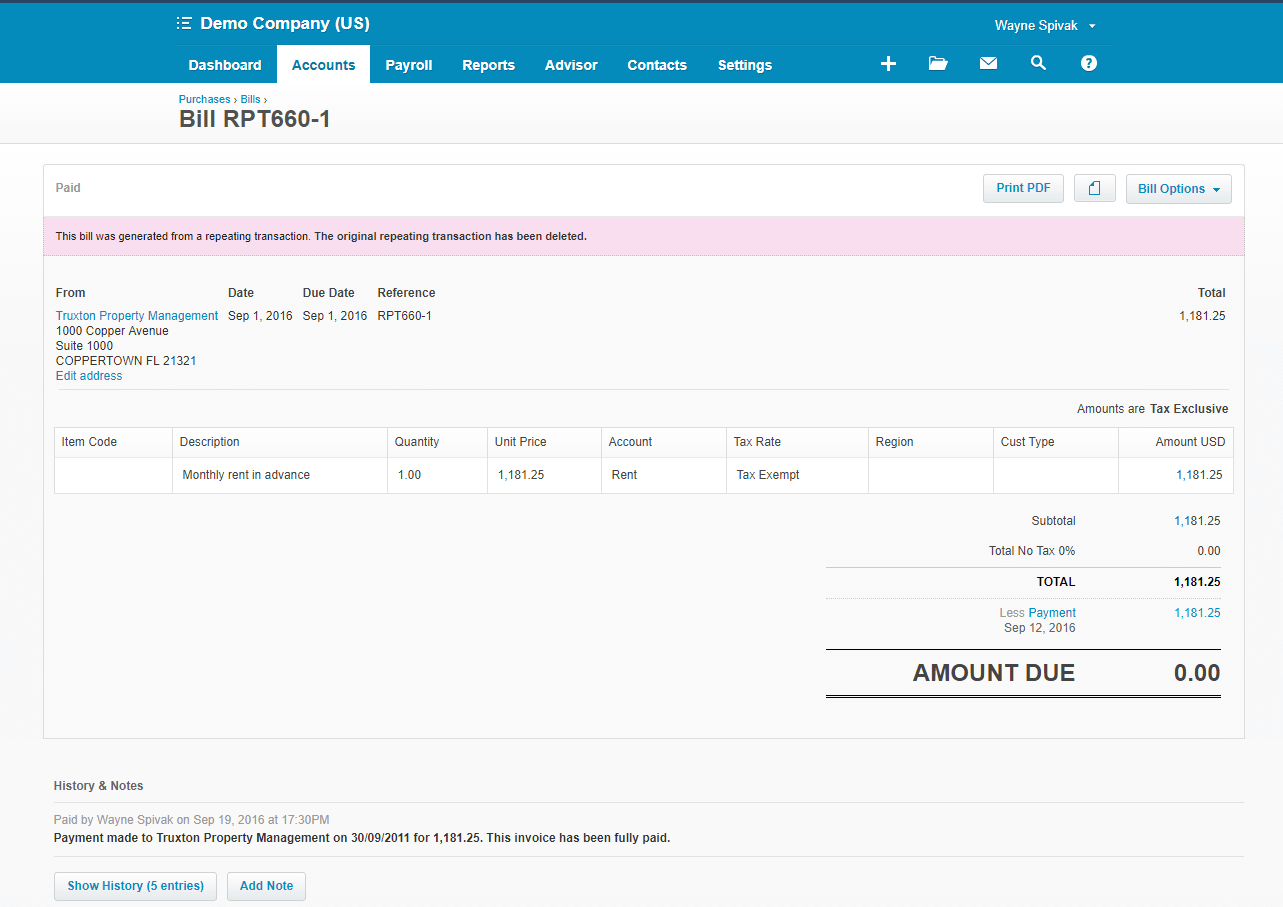

Purchase Invoice

The last drill down is the actual Purchase Invoice. Xero uses the terminology “Bills” to distinguish Accounts Payable Invoices as opposed to Sales Invoices.

Now you can see which general ledger account was involved in the transaction, any sale taxes, and again a full audit trail.

Many of today’s accounting systems have a direct feed into your bank account and can download all the transactions. It makes doing a bank reconciliation easy, fast and you no longer need to wait till the bank statement comes. We here at SBA * Consulting actually do bank reconciliations daily. We always know our bank balance, our outstanding checks and most importantly our book balance.

Can you say the same? Need help, why not contact us!